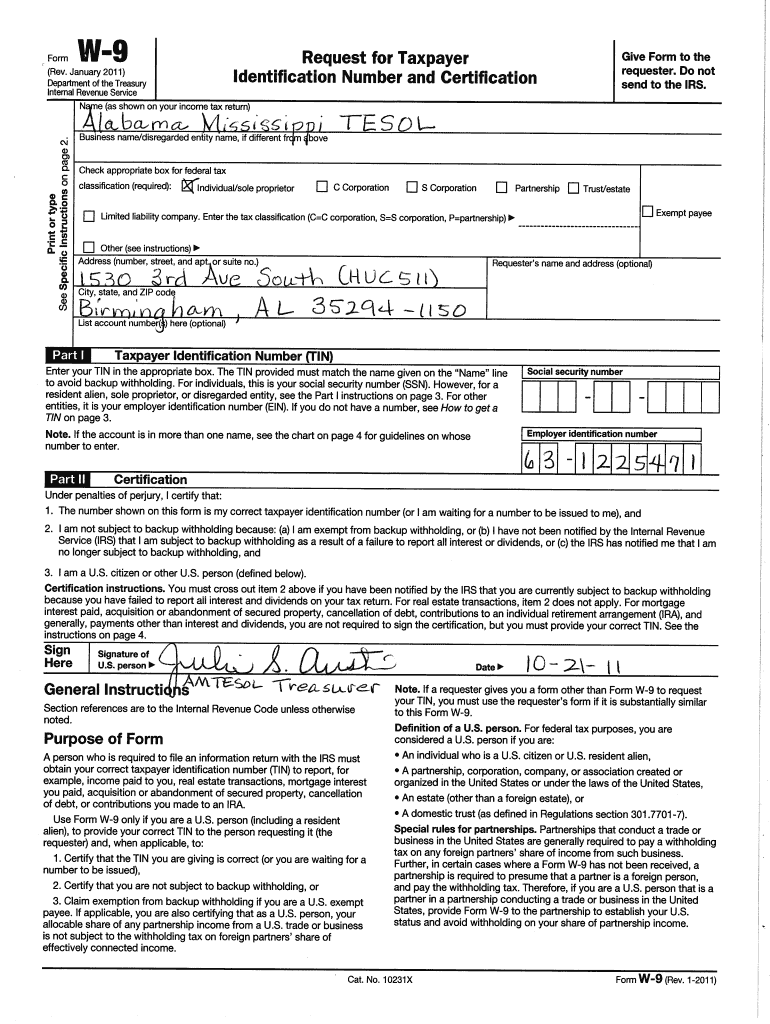

Free Printable W9 Tax Form

Free Printable W9 Tax Form - The tin provided must match. Enter your tin in the appropriate box. Tax on certain types of income, you must attach a statement to. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Enter the tax classification (c=c corporation, s=s corporation, p=partnership). Contained in the saving clause of a tax treaty to claim an exemption from u.s. Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the.

Blank W9 2018 2019 Free W9Form To Print W9 Form Printable 2017

Contained in the saving clause of a tax treaty to claim an exemption from u.s. Tax on certain types of income, you must attach a statement to. The tin provided must match. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Enter the tax classification (c=c corporation,.

W9 Form Fillable Request for Taxpayer Identification Number

Enter your tin in the appropriate box. Enter the tax classification (c=c corporation, s=s corporation, p=partnership). Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Tax.

Printable W9 Form 2025 Free Francis L. Rivera

Enter the tax classification (c=c corporation, s=s corporation, p=partnership). This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Contained in the saving clause of a tax treaty to claim an exemption from u.s. The tin provided must match. Enter your tin in the appropriate box.

How to Submit Your W 9 Forms Pdf Free Job Application Form

Enter the tax classification (c=c corporation, s=s corporation, p=partnership). Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Contained in the saving clause of a tax.

Fillable W 9 Form Pdf Printable Forms Free Online

Contained in the saving clause of a tax treaty to claim an exemption from u.s. Tax on certain types of income, you must attach a statement to. Enter your tin in the appropriate box. The tin provided must match. Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the.

Form W9, Request for Taxpayer Identification Number (TIN) and Stock

Tax on certain types of income, you must attach a statement to. Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. The tin provided must match. Enter your tin in the appropriate box. Contained in the saving clause of a tax treaty to claim an exemption from u.s.

Irs Fillable Form W 9 Printable Forms Free Online

Enter your tin in the appropriate box. Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. The tin provided must match. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Contained in the saving clause.

How to fill in W9 tax form and securely sign it using DocuSign

Enter the tax classification (c=c corporation, s=s corporation, p=partnership). Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Contained in the saving clause of a tax.

What Is A W9 Form 2025 Nabil Ivy

Contained in the saving clause of a tax treaty to claim an exemption from u.s. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. The tin provided must match. Tax on certain types of income, you must attach a statement to. Download or print the 2024 federal.

Free Irs Form W9 Printable Printable Forms Free Online

Tax on certain types of income, you must attach a statement to. Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. Enter the tax classification (c=c corporation, s=s corporation, p=partnership). This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper.

Enter the tax classification (c=c corporation, s=s corporation, p=partnership). Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. The tin provided must match. Tax on certain types of income, you must attach a statement to. Contained in the saving clause of a tax treaty to claim an exemption from u.s. Enter your tin in the appropriate box.

Contained In The Saving Clause Of A Tax Treaty To Claim An Exemption From U.s.

This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. The tin provided must match. Tax on certain types of income, you must attach a statement to. Download or print the 2024 federal (request for taxpayer identification number and certification) (2024) and other income tax forms from the.

Enter The Tax Classification (C=C Corporation, S=S Corporation, P=Partnership).

Enter your tin in the appropriate box.